Welcome to this article on Meliopayments and alternative payment solutions. In today’s digital age, businesses need efficient and reliable payment management software to streamline their financial operations. Meliopayments have emerged as a popular choice for many organizations, but it’s always beneficial to explore other available options in the market. In this article, we will discuss the significance of payment management software, explore various payment processing tools, and delve into Melio Payments as one of the leading solutions in the industry.

Welcome to this article on Meliopayments and alternative payment solutions. In today’s digital age, businesses need efficient and reliable payment management software to streamline their financial operations. Meliopayments have emerged as a popular choice for many organizations, but it’s always beneficial to explore other available options in the market. In this article, we will discuss the significance of payment management software, explore various payment processing tools, and delve into Melio Payments as one of the leading solutions in the industry.

Melio Payments Alternative Pay Vendor With Credit Card, Multiple Payment Option Printable Checks, eChecks, ACH, Wire Transfer, Check Mailing

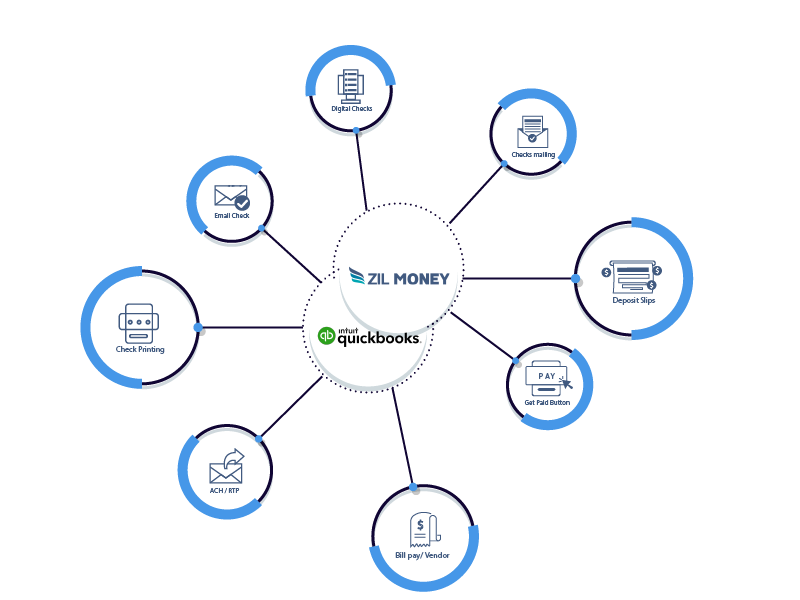

Meliopayments Alternative, Zil Money, eases your payment processing. With Zil Money, you can pay your vendors with your credit card even if they don’t accept them. You can pay any business with credit cards; pay rent and taxes easily. In addition, you can earn points for almost anything you buy. The Melio service alternative Zil Money provides you with an online banking service named ZilBank. Pay and Get paid by wire, check drafts, and check by mail at low transaction fees on Zil.

Payment Management Software

Payment management software plays a crucial role in businesses of all sizes. It helps organizations automate their payment processes, track transactions, and manage cash flow effectively. By utilizing payment management software, businesses can optimize their financial operations, reduce manual errors, and enhance overall efficiency.

One of the key features that payment management software provides is the ability to schedule and automate payments. This functionality allows businesses to set up recurring payments for bills, employee salaries, and other expenses. By automating these processes, organizations can save time and reduce the risk of late payments or penalties.

Additionally, payment management software often integrates with accounting systems, providing real-time synchronization of payment data. This integration ensures accurate financial records and minimizes the manual effort required to reconcile payments with invoices.

Payment Processing Tools

Payment processing tools are essential for businesses to accept payments from their customers, whether it’s through online transactions or in-person payments. These tools provide the necessary infrastructure to securely handle payment information and facilitate smooth financial transactions. Meliopayments

There are various payment processing tools available in the market, each with its own set of features and advantages. Some popular options include:

Stripe

Stripe is a robust payment processing tool that enables businesses to accept payments online. It offers an intuitive interface, extensive documentation, and a variety of customization options. Stripe supports multiple payment methods, making it convenient for customers to complete transactions using their preferred payment options.

Square

Square is a payment processing tool that focuses on in-person transactions, particularly for small businesses. It offers a range of hardware options, such as card readers and point-of-sale systems, to facilitate payments at physical locations. Square also provides additional features like inventory management and customer relationship management tools.

Melio Payments

Now let’s shift our focus to Meliopayments, one of the leading payment management solutions available. Melio Payments is specifically designed for small and medium-sized businesses, offering a user-friendly interface and a host of powerful features.

One notable feature of Melio Payments is its ability to consolidate all payments in one place. It allows businesses to manage payments to vendors and contractors through a single platform, simplifying the entire payment process. This centralized approach saves time and effort for businesses, as they no longer need to maintain multiple systems or manually reconcile payments.

Another advantage of Melio Payments is its integration capabilities. It seamlessly integrates with popular accounting software such as QuickBooks, allowing for automatic synchronization of payment data. This integration helps businesses maintain accurate financial records and reduces the risk of data entry errors.

Meliopayments also offers a range of payment methods, including ACH transfers and credit card payments. It provides businesses with the flexibility to choose the payment method that best suits their needs and preferences. By offering multiple payment options, Melio Payments ensures that businesses can cater to the payment preferences of their vendors and contractors.

Furthermore, Melio Payments provides advanced security measures to safeguard payment information. It utilizes encryption protocols and secure data storage to protect sensitive financial data from unauthorized access. This commitment to security gives businesses peace of mind when processing payments through the platform.

In conclusion, payment management software and payment processing tools are vital for businesses to streamline their financial operations and improve efficiency. While Meliopayments is a trusted and popular option, it’s beneficial to consider alternative payment solutions to find the best fit for your organization’s needs. Whether it’s Stripe, PayPal, Square, or other payment processing tools, each option presents unique features and benefits.

When evaluating payment solutions, businesses should consider factors such as integration capabilities, payment methods, security measures, and the specific requirements of their industry. By selecting the right payment management software and payment processing tools, businesses can optimize their financial processes, enhance cash flow management, and ultimately drive growth and success.