The financial technology (fintech) landscape is undergoing a remarkable transformation, driven by innovative mobile applications. Fintech app development has become a crucial avenue for businesses to offer seamless financial services and solutions to users. Outsourcing a fintech app development company, especially from countries like India, can be a strategic move to ensure the success of your project. In this comprehensive guide, we’ll walk you through the steps to outsource a top mobile app development company for your fintech venture.

Understanding the Power of Fintech App Development:

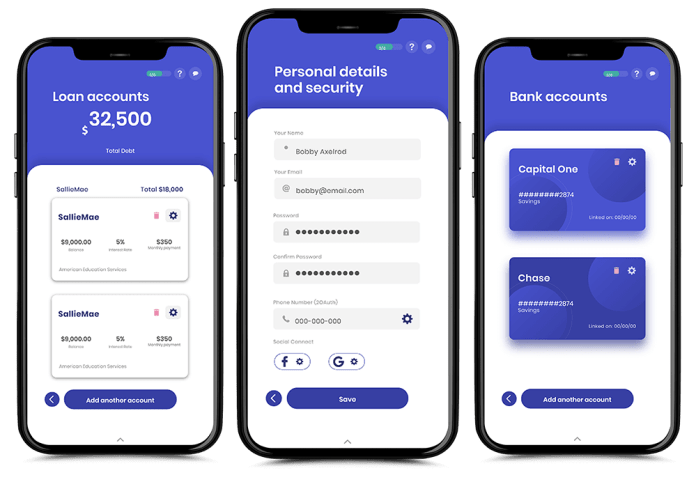

Fintech apps are reshaping how individuals and businesses manage their finances, make payments, invest, and more. These applications blend financial services with cutting-edge technology, providing users with convenience, speed, and security. As the fintech sector continues to expand, tapping into the expertise of an outsourced fintech app development company can help you stay ahead in this competitive market.

1. Define Your Fintech Project Objectives:

Begin by clearly defining the objectives of your fintech app project. Determine the specific financial services or solutions you intend to offer through the app. Whether it’s digital payments, investment management, peer-to-peer lending, or another fintech niche, having a clear vision will guide your discussions or hire indian app developers.

2. Research and Shortlisting:

Conduct thorough research to identify reputable fintech app development companies, both within your region and abroad. Look for companies with a strong track record in creating fintech apps and a portfolio that aligns with your project goals. Online reviews, client testimonials, and case studies can offer insights into their capabilities.

Also Check: Latest Digital Payment Trends To Watch in 2023

3. Evaluate Technical Expertise:

Assess the technical expertise of the shortlisted app development companies. Check their experience in developing apps for both iOS and Android platforms. Fintech apps often involve complex functionalities, so inquire about their familiarity with technologies such as blockchain, payment gateways, data encryption, and secure authentication methods.

4. Portfolio Analysis:

Review the portfolios of the potential fintech app development partners. Pay attention to the user interfaces, design aesthetics, and functionality of their previous projects. A strong portfolio indicates their ability to create user-centric experiences that align with your app’s goals.

5. Services Offered:

Inquire about the services offered by the mobile app development companies. A comprehensive package should include app design, development, quality assurance, and post-launch maintenance. A top mobile app development company will handle every aspect of the project, ensuring a seamless and consistent development process.

6. Stay Updated on Fintech Trends:

Fintech is a dynamic field that evolves rapidly. Ensure that the outsourced company is up-to-date with the latest fintech trends, such as contactless payments, robo-advisors, blockchain-based solutions, and AI-driven chatbots. Discuss how these trends can be incorporated into your app to enhance its competitiveness.

Read more: Top 10 Mobile App Development Companies in the USA

7. Communication and Collaboration:

Effective communication is paramount in an outsourcing partnership. During your interactions, assess the communication skills of the potential developers. Are they responsive to your queries? Do they understand your vision and goals? A clear and collaborative communication channel ensures that your app’s development remains on track.

8. Budget and Cost Considerations:

Discuss the budget and cost expectations upfront. While cost-effectiveness is important, remember that quality development comes with a price. Avoid the temptation to opt for the cheapest option, as this could compromise the final product’s quality. Aim for a balance between affordability and expertise.

9. Seek Testimonials and References:

Request testimonials from previous clients or ask for references you can contact directly. Speaking with these references can provide insights into the app development company’s work ethics, professionalism, and ability to meet deadlines. Positive feedback gives you confidence in your choice.

10. Intellectual Property Protection:

Ensure that your intellectual property rights are protected. Discuss the ownership of the app’s source code and any proprietary information. This step ensures that your app’s core technology remains secure.

11. Security Measures:

Fintech apps handle sensitive financial data, making security a top priority. Inquire about the security measures implemented by the outsourced top mobile app development company, such as data encryption, two-factor authentication, and compliance with relevant industry regulations.

12. Collaboration Tools:

Clarify the tools and platforms the outsourced company uses for collaboration and project management. Tools like Slack, Trello, or Jira can streamline communication and keep you informed about the development progress.

13. Contract and Legal Aspects:

Draft a comprehensive contract that outlines the project scope, deliverables, timelines, payment terms, and intellectual property rights. Legal clarity safeguards both parties’ interests and ensures a smooth collaboration.

Visit: Healthcare App Development Company

Conclusion

Outsourcing a fintech app development company for your project is a strategic decision that demands careful consideration. By following this comprehensive guide, you can navigate the complex process of selecting the right partner for your fintech app development needs. Collaborating with a top mobile app development company, especially from India known for its expertise, can lead to a successful fintech app that meets user expectations, offers innovative solutions, and contributes to the growth of the fintech industry.

Related Fintech Article:

- AI – Artificial Intelligence in The Finance Industry

- How to Build a Payment App Like Cash App

- Top 10 Fintech Trends to Watch Out in 2023