The convergence of financial technology (fintech) and gamification has given rise to a powerful force that is reshaping the financial services landscape. Gamification, which leverages game elements to engage and motivate users, is making substantial inroads into the fintech sector, transforming the way consumers interact with financial products and services. Gamification within the realm of finance or digital banking represents an enjoyable and highly impactful approach to elevate the services provided. It introduces an element of excitement and amicable rivalry to the everyday responsibilities of managing funds. However, it’s not limited to just that – gamified financial applications are setting new benchmarks in acquiring customers.

The gamification industry is currently experiencing substantial expansion and rapid development. According to the recent statistics published by Gitnux the gamification market is poised to achieve a market size of $32 billion by the year 2025, demonstrating an impressive Compound Annual Growth Rate (CAGR) of 27.4%. Sectors that are anticipated to witness a significant surge in gamification adoption include information technology (IT), banking, and the public sector. Furthermore, gamification solutions have the potential to boost user acquisition by a remarkable 600%.

In this blog, we’ll delve into how gamification is revolutionizing the fintech industry, backed by the latest statistics, facts, and figures. We’ll dissect the synergy between these two domains, backed by data, insights, and real-world examples. From boosting user engagement to enhancing financial literacy and fostering responsible financial habits, the impact of gamification in fintech is far-reaching and profound. Join us on this journey to uncover how this innovative approach is not only changing the way we manage our finances but also democratizing access to financial services and knowledge. Before we deep dive into how this new phenomenon is reshaping the global fintech industry, let’s understand what actually gamification is.

What is Gamification in Business?

In the world of modern commerce, where attention spans are short, and engagement is paramount, businesses are turning to innovative strategies to capture and maintain the interest of their customers, employees, and stakeholders. One such strategy gaining immense popularity is “gamification.” But what exactly is gamification in business?

At its core, gamification harnesses the principles of game design and applies them to non-gaming scenarios, such as marketing, employee training, customer loyalty programs, and more. By incorporating elements like challenges, rewards, competition, and achievements, businesses aim to motivate, engage, and incentivize their target audience. In this exploration of gamification in business, we’ll delve into the key concepts, applications, and the transformative impact it has on various aspects of modern enterprises.

The Gamification Phenomenon in Fintech: A Bird’s Eye View

Gamification in fintech is not a mere buzzword; it’s a tangible shift that’s driving user engagement, fostering financial literacy, and enhancing customer experiences.

Here’s a closer look at this transformative trend:

-

Boosting User Engagement

Fintech companies are increasingly turning to gamification to enhance user engagement. According to a recent survey by Deloitte, fintech applications that employ gamification techniques report an astonishing 7x increase in user engagement compared to their non-gamified counterparts. By incorporating game-like features such as challenges, achievements, and rewards, fintech platforms are enticing users to interact more frequently and meaningfully with their services.

-

Improving Financial Literacy

Gamification is also proving to be an effective tool in improving financial literacy. A study by the National Endowment for Financial Education found that individuals who learn financial concepts through gamified experiences demonstrate a 30% higher understanding of financial topics compared to traditional learning methods. This educational approach is pivotal for making informed financial decisions, particularly among younger generations.

-

Enhancing Customer Experiences

User experience is at the core of fintech success, and gamification plays a pivotal role in creating more enjoyable and user-friendly interfaces. A study conducted by PwC revealed that 74% of financial services executives consider gamification as a critical component in providing an exceptional customer experience. It enables companies to simplify complex financial processes, making them more accessible and enjoyable for customers.

-

Encouraging Savings and Investments

Gamification is also a potent motivator when it comes to encouraging savings and investments. A report by Juniper Research indicates that fintech applications with gamified savings features have witnessed a 42% increase in users’ willingness to save regularly. Through the use of challenges and virtual rewards, users are more inclined to build sound financial habits and invest wisely.

-

Fostering Healthy Competition

Gamification instils a sense of competition among users, which can be harnessed to drive positive financial behaviours. The World Bank reports that gamification is instrumental in encouraging the unbanked and underbanked populations to participate in formal financial systems. This not only empowers individuals financially but also contributes to global financial inclusion goals.

Examples of Gamification in Fintech

Robinhood

Robinhood, a pioneer in the gamification of investing, has made stock trading accessible and engaging for millions of users. By offering a user-friendly mobile app that incorporates gamified elements, such as rewards and challenges, they’ve empowered a new generation of investors. Users can learn about investing, make trades, and experience the thrill of the stock market within a game-like environment. The platform even rewards users with virtual trophies for achieving specific milestones, turning stock trading into a gamified experience that appeals to a younger audience.

Qapital

Qapital, a financial app designed to help users save money, has ingeniously gamified the savings process. Users can set savings goals and establish rules for how they want to save. For instance, they can save a predetermined amount each time they make a purchase, and they can even set up saving “challenges” with specific goals and time frames. As users make progress toward their savings goals, they earn virtual rewards, reinforcing positive financial behaviors through gamification.

Mint

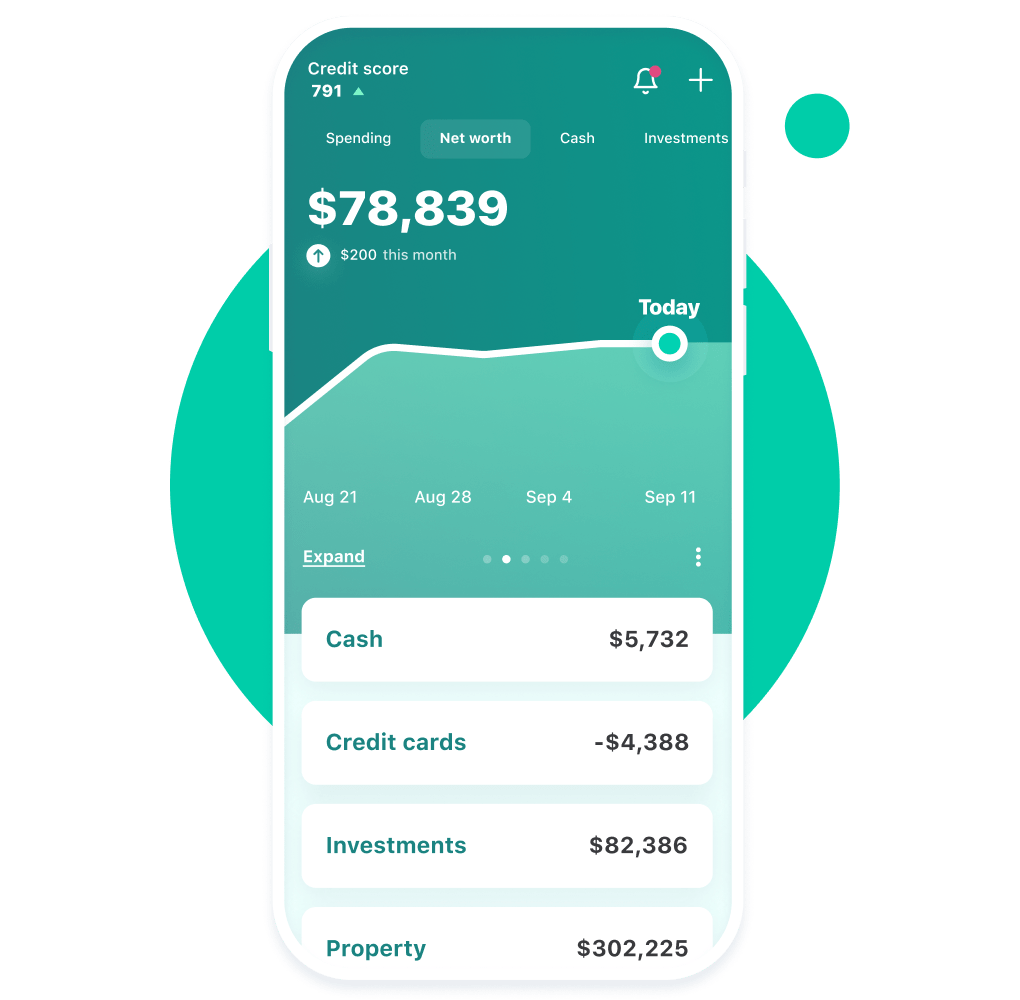

Mint, a popular personal finance app, employs gamification elements to encourage users to manage their finances effectively. Users can set financial goals, create budgets, and track their spending. The app provides feedback on their progress and achievements, fostering a sense of accomplishment and control over their financial lives. By making financial management more engaging and interactive, Mint helps users make informed financial decisions and develop better money habits.

Acorn

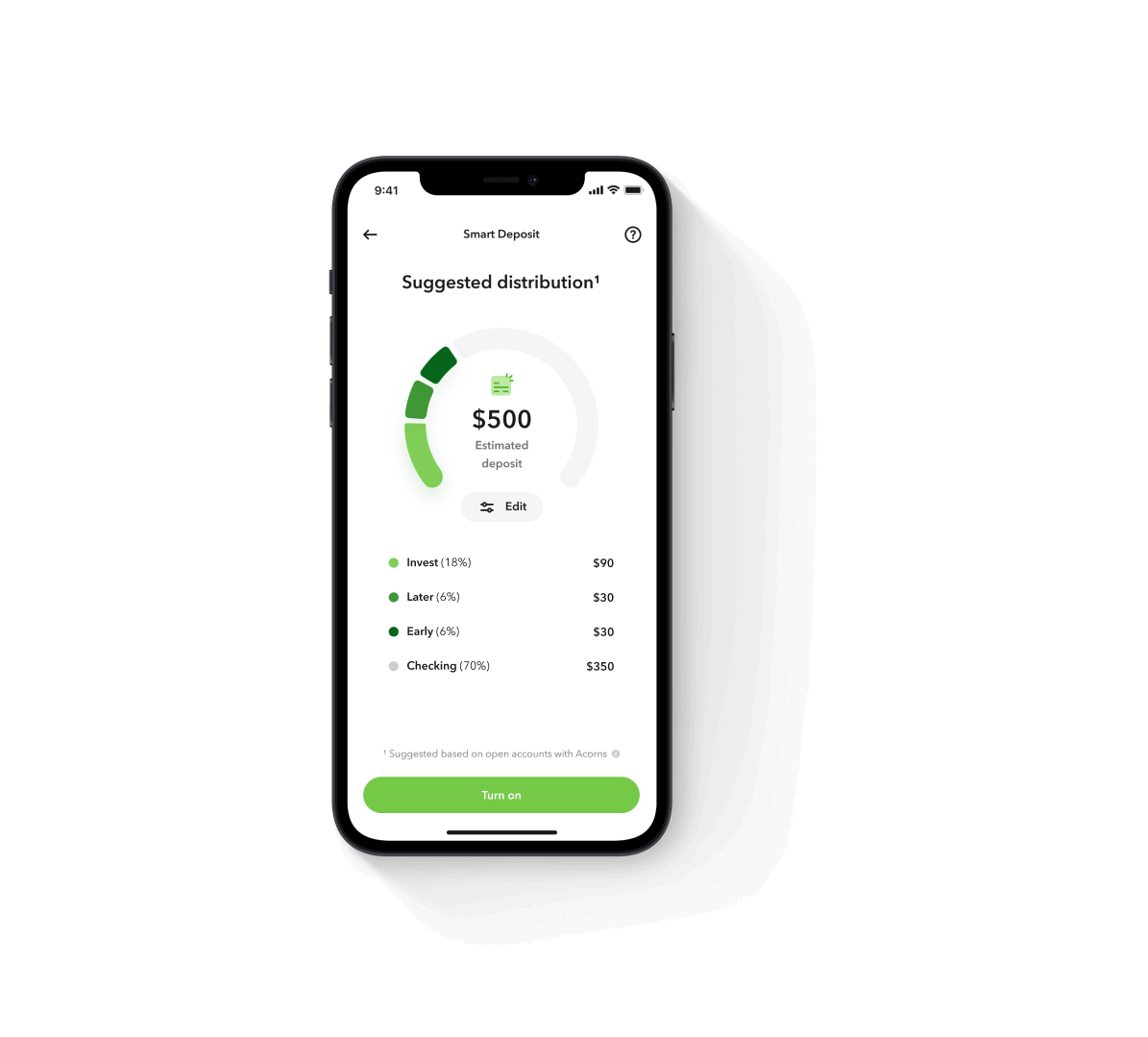

Acorns, an app known for its micro-investment services, gamifies saving and investing by implementing a “round-up” feature. Whenever users make a purchase, Acorns automatically rounds up the spare change to the nearest dollar and invests it. This small change adds up over time, making saving and investing an easy and game-like experience. Users can track their investment performance and watch their savings grow, turning financial responsibility into a rewarding journey.

These examples illustrate how gamification is being seamlessly integrated into fintech applications to enhance user engagement, promote financial literacy, and drive responsible financial behaviors. By incorporating elements like rewards, challenges, and achievements, these fintech companies are making financial management not only more accessible but also more enjoyable, catering to a diverse range of users and empowering them to make informed financial decisions. Gamification in fintech is not merely a trend; it’s a dynamic force that’s redefining the way we interact with our finances, and these examples are just the beginning of a transformative journey within the industry.

In an era where the finance sector is experiencing a profound shift towards gamification, the role of transformative digital agencies like Digital Gravity cannot be underestimated. These agencies act as catalysts for businesses operating in finance, helping them harness the potential of gamification technology to not only survive but thrive. By collaborating with agencies like Digital Gravity, financial institutions can tap into expert knowledge and innovative approaches to integrate gamification seamlessly into their services.