Today, we find it impossible to imagine life without tech. In particular, in the domain of money, it has changed how we organize our days, months, and even years. We can send capital, pay our bills, shop online, and manage how much we spend thanks to an extensive selection of fintech apps. They generally save us time and offer us a sense of comfort and financial security.

According to Vantage Market Research, the value of the around-the-world fintech market is estimated to be $ 133.84 billion in 2022 and to rise to USD 556.58 billion by 2030. Over the course of the forecast period, the global market is anticipated to expand at a compound annual growth rate (CAGR) of 19.50%. In this article, there will be a discussion about the steps for fintech mobile app and its cost to develop.

Steps for Fintech Mobile App Development Process

To build a fintech mobile app, follow these steps:

- Identify the target audience and define the app’s purpose and features.

- Conduct market research to understand user needs and analyze competitors.

- Create a comprehensive app development plan, including timelines and resources.

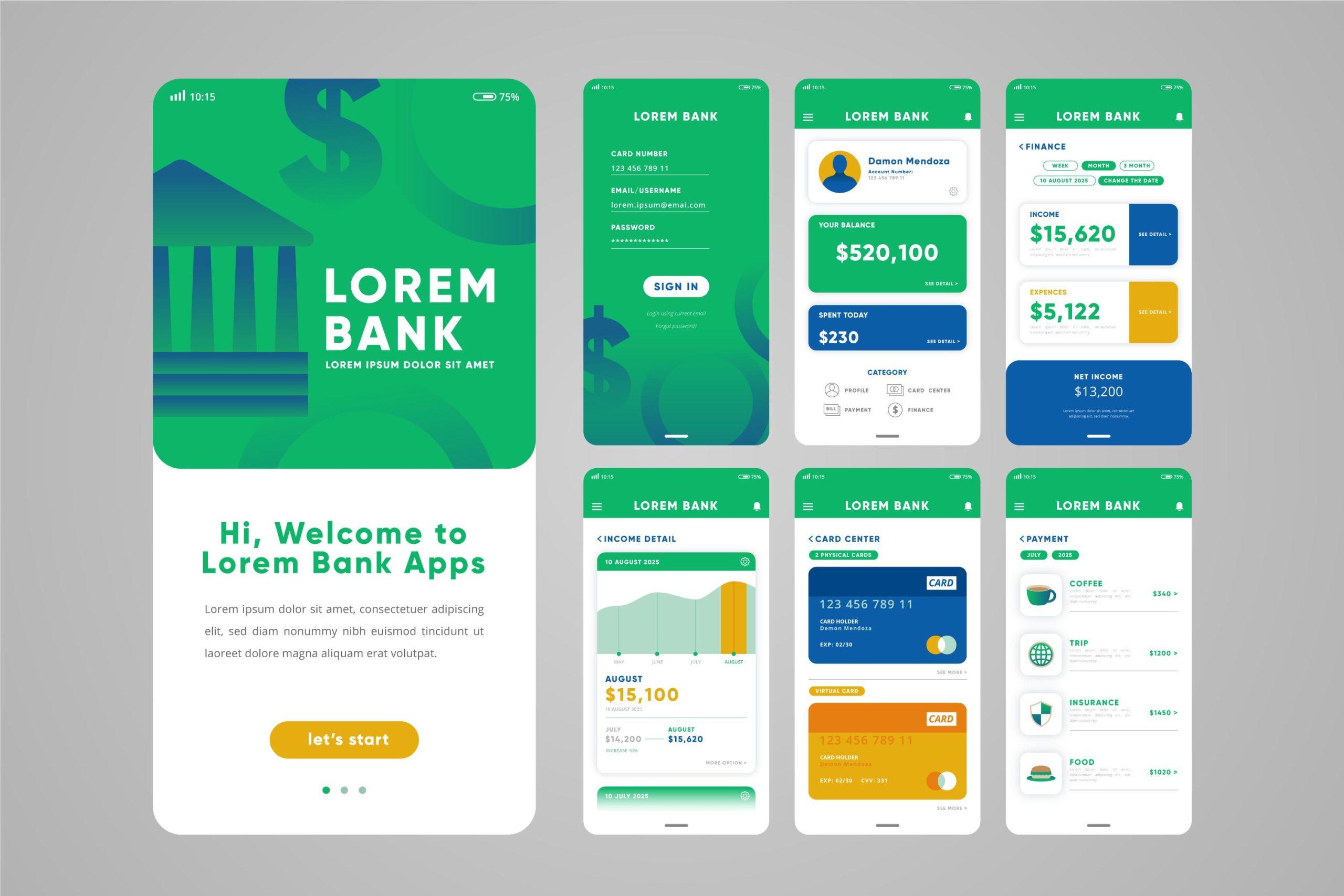

- Design an intuitive user interface (UI) and engaging user experience (UX) for the app.

- Develop the back-end infrastructure, including server setup, database creation, and API integration.

- Implement robust security measures to protect user data and financial transactions.

- Build the front end of the app using programming languages like Java or Swift.

- Integrate necessary financial APIs, such as payment gateways, banking systems, or investment platforms.

- Test the app thoroughly to ensure functionality, usability, and compatibility across various devices and platforms.

- Obtain legal compliance and necessary licenses, such as adhering to financial regulations and data protection laws.

- Deploy the app to relevant app stores, such as the Apple App Store and Google Play Store.

- Monitor and analyze user feedback, reviews, and app analytics to identify areas for improvement.

- Continuously update and maintain the app by releasing regular bug fixes and feature enhancements.

- Provide excellent customer support to address user queries and concerns.

- Consider implementing additional features, such as personalized financial recommendations or social integration, to enhance the app’s value proposition.

What is the Cost to Build Fintech Mobile App?

The average cost of developing a fintech app can vary widely, ranging from tens of thousands of dollars to several hundred thousand dollars or more. The specific cost depends on various factors, including the complexity of features, design requirements, development time, geographical location of the development team, and other project-specific considerations.

- Simple Fintech App: A basic fintech app with standard features like user registration, account management, basic financial transactions, and simple analytics may cost anywhere between $30,000 to $80,000.

- Moderate Fintech App: An app with additional features such as advanced analytics, personalized financial recommendations, integration with third-party APIs (e.g., payment gateways, banking systems), and enhanced security measures could range from $80,000 to $150,000.

- Complex Fintech App: A highly sophisticated fintech app with intricate features like AI-driven financial planning, investment portfolio management, multi-currency support, regulatory compliance, advanced data encryption, and comprehensive backend systems may cost $150,000 or more.

Keep in mind that these figures are estimates and can vary significantly depending on your specific requirements and the factors mentioned earlier. Additionally, the hourly rates charged by development agencies or freelance developers also influence the overall cost.

It’s advisable to gather detailed proposals from multiple vendors and discuss your project specifics with them to get a more accurate cost estimate for your particular fintech app development company. Although, fintech app development services can help you to develop fascinating mobile apps.

Crucial Areas of Fintech Mobile Apps .

- Scope and Features: The more complex and extensive the features of your fintech app, the higher the development cost will be. Features like user authentication, payment integration, data analysis, security measures, and third-party API integration can increase the development cost.

- Design and User Experience: A well-designed and user-friendly interface is crucial for a fintech app. Investing in quality UI/UX design may increase the development cost but can greatly enhance user engagement and satisfaction.

- Development Team: The size and expertise of the development team will impact the cost. Hiring experienced developers, designers, and testers may be more expensive but can ensure a higher quality end product.

- Platform and Devices: Developing a fintech app for multiple platforms (iOS, Android) or optimizing it for various devices (smartphones, tablets) will add to the overall cost.

- Security and Compliance: Fintech apps deal with sensitive user data and financial transactions, so implementing robust security measures and ensuring regulatory compliance can increase the development cost.

- Maintenance and Support: Ongoing maintenance, bug fixing, and updates after the app launch will require additional investment. You need to connect with fintech app developers for proper maintenance.

It’s advisable to consult with several app development agencies or freelance developers to get accurate cost estimates based on your specific project requirements. They can provide you with detailed proposals and breakdowns of the costs involved.

Read more: What are the Most Advanced Features for Fintech Web Apps in 2023?

Conclusion

In conclusion, building a fintech mobile app involves a series of well-defined steps and considerations. By following these steps, you can create a successful app that caters to your target audience’s needs. Starting from identifying the target audience and defining the app’s purpose and features, conducting market research, and creating a comprehensive development plan, you lay the foundation for a successful project.

Additionally, integrating necessary financial APIs, thorough testing, obtaining legal compliance, and deploying the app to relevant app stores ensure a smooth user experience. Monitoring user feedback and analytics, maintaining regular updates, and providing excellent customer support contribute to the app’s long-term success. When considering the cost of building a fintech app, various factors come into play.